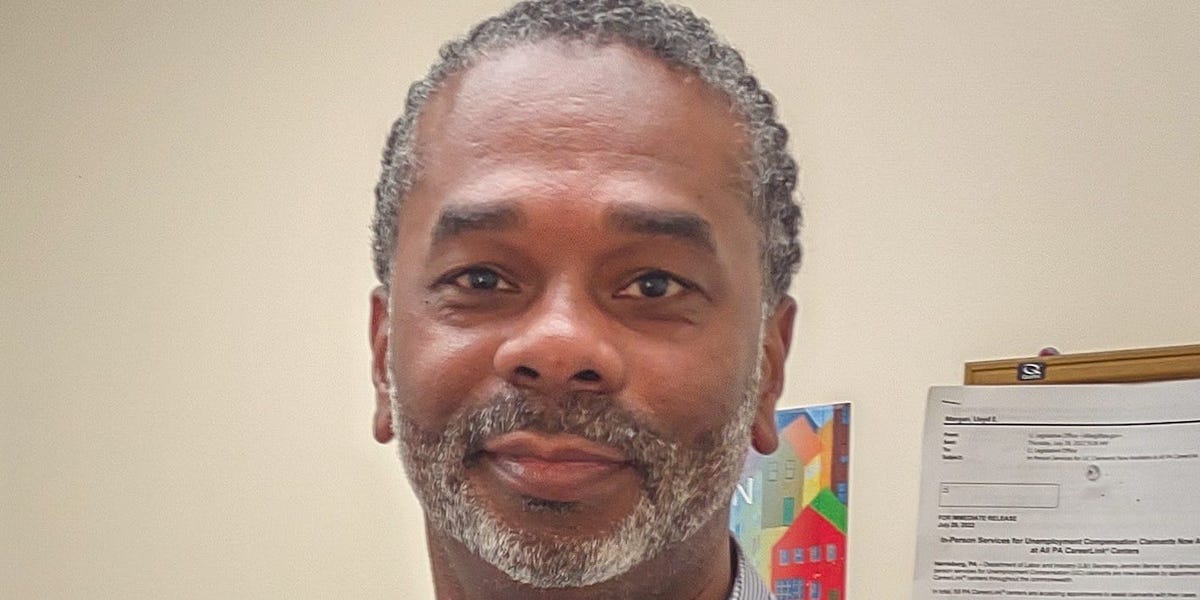

A former compliance officer has been awarded almost £565,000 ($745,000) after he was fired for alerting authorities about an employee who turned out to be a “Chinese espionage agent.”

Bharat Bhagani, who worked in the UK office of Goldenway Global Investments, a trading services provider based in Hong Kong, was awarded the payout by an employment tribunal in London, according to a judgment published this week.

The whistleblower said that in 2022 his company asked him to secure a British work visa for an individual who was later deported from the UK. The tribunal ruling stated that Bhagani was told by UK authorities that the person was a “Chinese espionage agent.”

Bhagani informed the Financial Conduct Authority, the UK regulator, that there had been two unauthorized appointments of Hong Kong residents without FCA approval.

He also alerted the regulator of alleged money laundering, fraudulent inter-company loans, and people acting as directors without regulatory approval.

The tribunal heard that the former compliance officer received a warning letter in June 2022 outlining that he had not been “cooperative on assisting the company to enroll appropriate staff,” because he did not comply with his order to secure the visa.

The letter said any further breach could result in suspension and termination of his employment.

About two weeks later Bhagani was dismissed for gross misconduct for failing to obey instructions from company directors.

He took Goldenway to the tribunal in 2022. It found that Bhagani had been unfairly dismissed because his employer did not follow due process, adding: “The respondent had no genuine belief he had committed gross misconduct, and where the reason for dismissal was his public interest disclosures.”

After he was fired, Bhagani also claimed he missed out on a job offer because the reference supplied by a Goldenway director said he had been terminated for gross misconduct.

Bhagani was awarded a total of £564,672 ($744,223) in compensation, according to the remedy judgment.

Goldenway was first subject to FCA restrictions and then banned from operating in the UK.

Goldenway Global Investments did not respond to a request for comment from Business Insider.