Yentervention – again?

The Japanese Yen has been under immense pressure in recent months, with the USD/JPY exchange rate hovering near the psychologically important level of 160 yen per dollar. This marks the Yen’s weakest level against the greenback in nearly 34 years, raising concerns about the stability of Japan’s currency and its potential impact on the Global Economy.

In response to the Yen’s rapid depreciation, Japan’s top currency official, Masato Kanda, has issued a stern warning to the markets. Kanda, who serves as the Vice Finance Minister, stated that Japanese authorities are prepared to intervene in the currency markets around the clock if necessary. He emphasized that excessive currency fluctuations can have a detrimental effect on the nation’s economy and that the government is ready to take appropriate action against speculative moves.

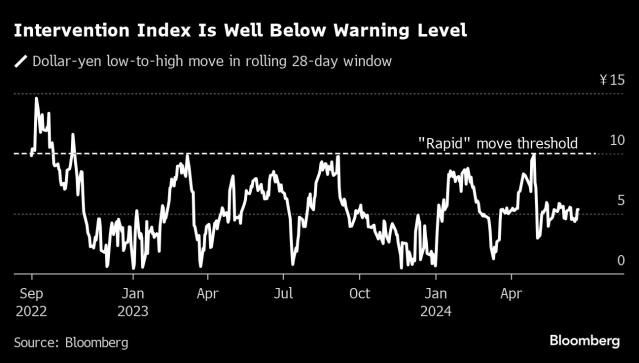

Japan has a history of intervening in the foreign exchange markets to stabilize the Yen. In fact, between April 26 and May 29, the country spent a staggering ¥9.8 TRILLION ($61.3Bn) on currency intervention. This massive expenditure underscores the Japanese Government’s determination to prevent further weakening of the Yen and maintain some form of economic stability.

However, despite these efforts, the Yen has continued to slide against the Dollar. The vast majority of the gains made by the Yen following the suspected interventions on April 29 and May 1 have been erased, raising doubts about the effectiveness of such measures in the long run.

The primary reason for the Yen’s vulnerability lies in the stark contrast between Japan’s monetary policy and that of other major economies, particularly the United States. While the Bank of Japan (BOJ) has maintained ultra-low interest rates, with benchmark rates barely above zero, the U.S. Federal Reserve has been on a path of monetary tightening. This divergence in policy has created a significant yield gap between the two nations, making the Yen less attractive to investors seeking higher returns.

Some experts argue that Japan may not have the firepower to sustain long-term interventions in the currency markets. The country’s foreign exchange reserves, while substantial, are not infinite, and repeated interventions can be costly. Moreover, unilateral interventions by the BOJ may have limited impact in the face of broader market forces and the actions of other central banks.

It is worth noting that currency intervention is not without controversy. The U.S. Treasury Department recently added Japan to its currency watchlist, citing the country’s large-scale interventions in the foreign exchange market. While Kanda has stated that this decision has no impact on Japan’s currency strategy, it highlights the international scrutiny that such actions can attract.

Japan’s promise of round-the-clock intervention to support the Yen is a bold statement aimed at stabilizing the currency and preventing further depreciation. However, the effectiveness of such measures remains uncertain, given the limited success of recent interventions and the fundamental differences in monetary policy between Japan and other major economies. As the Global Economic Landscape continues to evolve, it will be crucial to monitor the actions of the BOJ and the response of the markets to determine the future trajectory of the Yen and its impact on the wider financial system.

The Yen’s weakness has significant ramifications for international trade. As the third-largest economy in the world, Japan is a major player in global commerce. A weaker Yen makes Japanese exports more competitive, as they become cheaper for foreign buyers. This could lead to increased demand for Japanese goods, potentially boosting the profits of export-oriented companies in Japan. However, it also means that imports become more expensive for Japanese consumers and businesses, which could dampen domestic consumption and investment.

The Yen’s weakness has significant ramifications for international trade. As the third-largest economy in the world, Japan is a major player in global commerce. A weaker Yen makes Japanese exports more competitive, as they become cheaper for foreign buyers. This could lead to increased demand for Japanese goods, potentially boosting the profits of export-oriented companies in Japan. However, it also means that imports become more expensive for Japanese consumers and businesses, which could dampen domestic consumption and investment.

The impact of the Yen’s depreciation is mixed. On one hand, exporters like Toyota (TM), Sony (SONY), and Hitachi (HTHIY) may benefit from increased international sales. On the other hand, companies that rely heavily on imported raw materials or have significant foreign currency-denominated debt will face higher costs and potential balance sheet strains.

The Yen’s weakness also has implications for commodity markets. Japan is a major importer of energy, including Oil, Natural Gas, and Coal. A weaker Yyen makes these imports more expensive, which could put upward pressure on global energy prices. This, in turn, could affect the profitability of energy-intensive industries worldwide and contribute to inflationary pressures.

The Yen’s weakness also has implications for commodity markets. Japan is a major importer of energy, including Oil, Natural Gas, and Coal. A weaker Yyen makes these imports more expensive, which could put upward pressure on global energy prices. This, in turn, could affect the profitability of energy-intensive industries worldwide and contribute to inflationary pressures.

Moreover, the BOJ’s interventions and the Yen’s fluctuations can influence global capital flows and investor sentiment. If the Yen continues to weaken, Japanese investors may seek higher returns overseas, leading to increased capital outflows from Japan. This could impact asset prices and currency markets in the countries receiving these flows, such as the United States and Europe.

Furthermore, the BOJ’s actions and the Yen’s trajectory could have spillover effects on other central banks’ policies. If the Yen’s weakness persists, it may put pressure on other export-oriented economies, like South Korea and Taiwan, to intervene in their own currency markets to maintain competitiveness. This could lead to a “race to the bottom” in terms of currency devaluation, potentially destabilizing the global financial system.

The Yen’s status as a safe-haven currency means that its weakness could have implications for global risk sentiment. In times of economic uncertainty or geopolitical tensions, investors often flock to the Yen as a stable store of value. If the Yen continues to depreciate, it may lose some of its safe-haven appeal, potentially exacerbating market volatility during risk-off events.

The future path of the Yen and the BOJ’s policy actions have far-reaching consequences for global markets, trade, and investor sentiment. PSW Members should keep a close eye on these developments, as they could have significant implications for our portfolios and the broader economic landscape. By understanding the interconnectedness of currencies, commodities, and capital flows, our Members can make more informed decisions and navigate the complex web of global financial markets.

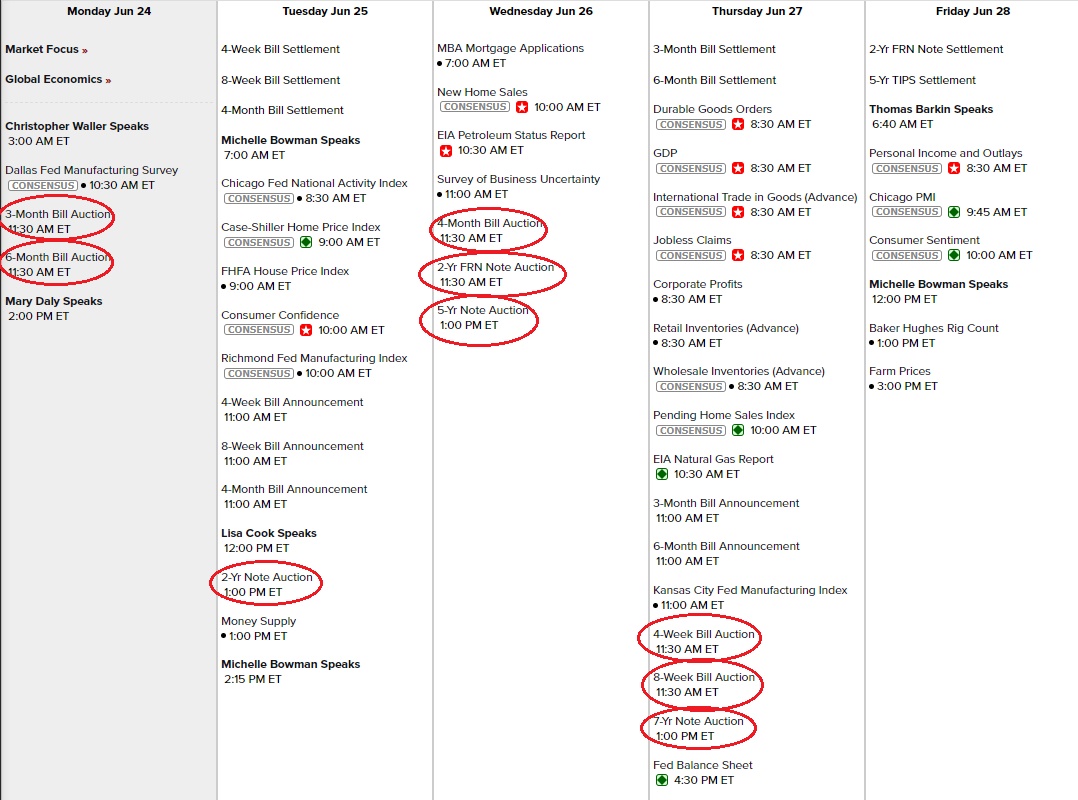

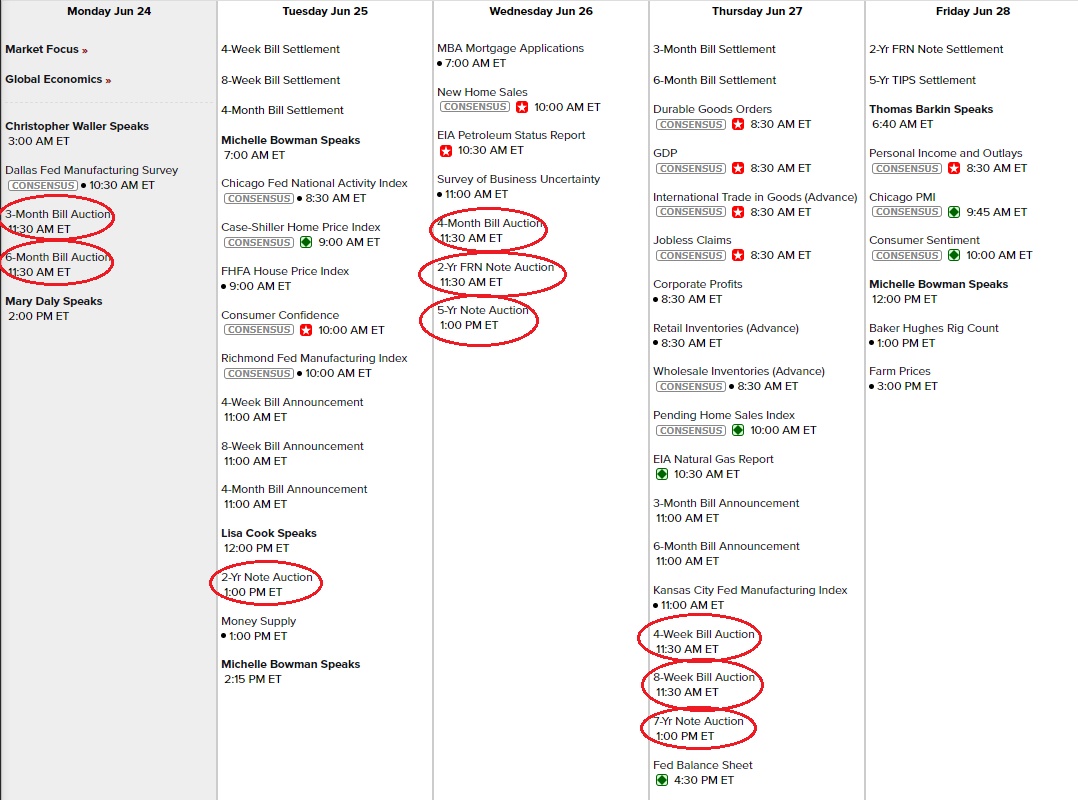

Back in the US, it’s a busy data week highlighted by Consumer Confidence tomorrow, Durable Good and another Q2 GDP Estimate (1.3% expected is way too low) on Thursday and Personal Income & Spending along with PCE Prices and Consumer Sentiment on Friday. This will be broken up by 6 scheduled Fed Speeches and, of course, many, many note auctions because – yes – we need A LOT OF MONEY to keep the lights on in the US these days yet, for some reason – our currency hasn’t collapsed… yet…

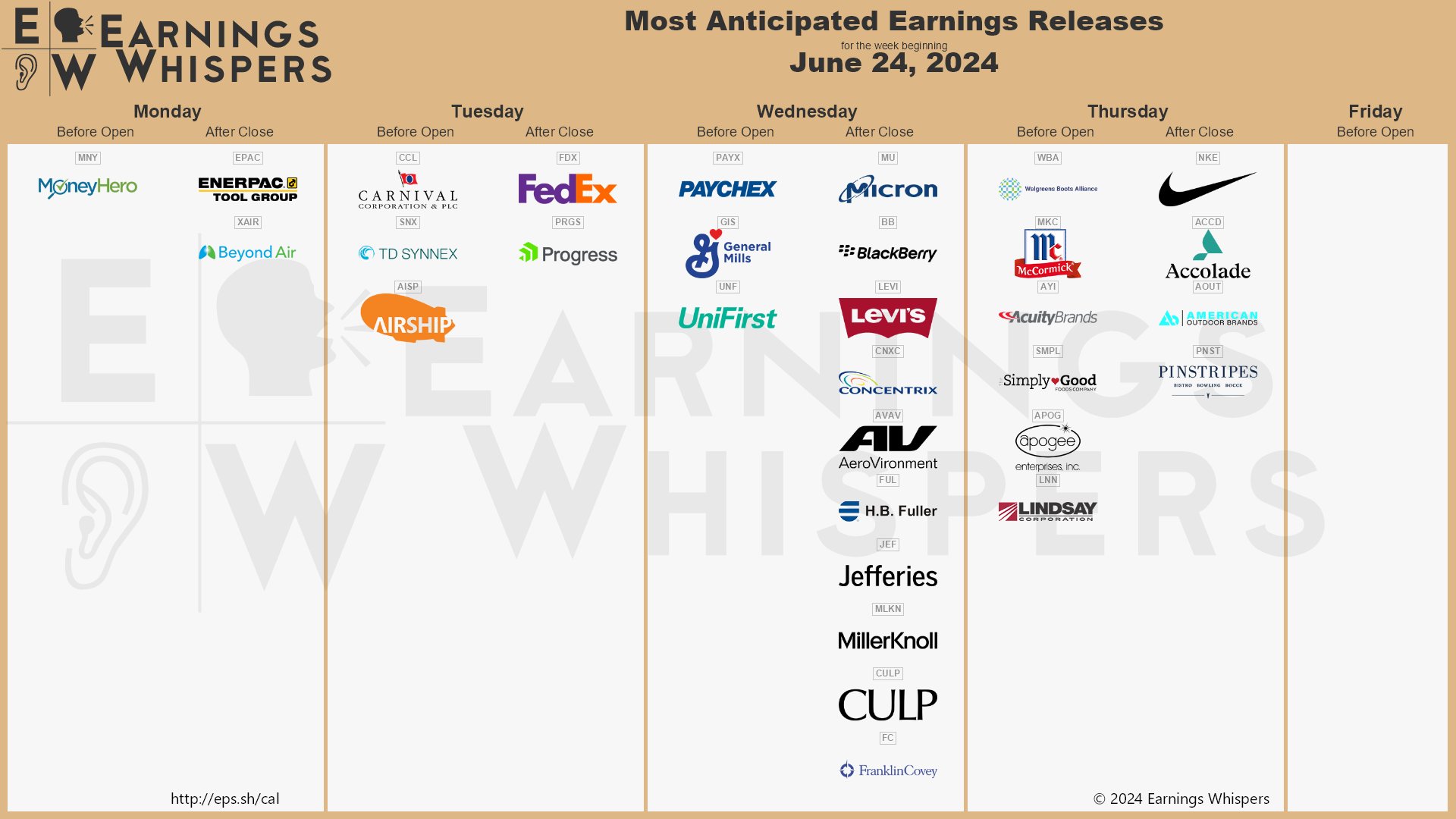

And not too many earnings but they sneak a few big ones in on you when you’re not paying attention:

Should be a fun, full week but then it’s time for another holiday!

Enjoy…