Chuong Nguyen

When we think of banking security, we often think of using strong passwords, not recycling old passcodes, and adding multi-factor authentication to accounts. But having good physical security is just as important as practicing good online security hygiene. With many debit cards and credit cards shipping with NFC, there is a real risk that valuable financial information can be skimmed–even if the skimming is not done with malicious intent.

In April 2023, a San Francisco ABC News affiliate reported that a local Safeway grocery store had inadvertently charged a customer’s card while it was still in her purse. The credit card charge was facilitated by an overly sensitive tap-to-pay payment terminal at the checkout stand that had detected the NFC-enabled American Express card in the customer’s purse.

To better understand what had happened in the hope of preventing a repeat incident, the affected Safeway patron had reached out to the grocer. But instead of receiving a sympathetic apology, Safeway essentially blamed the customer, informing her that she should have her credit card cards protected.

So how do you protect your credit and debit cards from malicious skimmers and money-hungry merchants? There are several security solutions you can take to better protect your physical cards.

Inexpensive credit card sleeves are a cheap solution

Chuong Nguyen

Inexpensive credit card sleeves are slim and a great solution for those who want to protect information on one or two cards. These paper-like sleeves are lined with RFID-blocking materials like fiberglass, foil, or a combination of the two, making it virtually impossible for skimming machines, NFC payment terminals, and card readers to penetrate the sleeve and read the information on your card.

RFID-blocking card sleeves

The United States Department of State is a big consumer of card sleeves, shipping every new passport card in a protective envelope that shields the RFID chips from transmitting identifiable information about its citizens. The sleeves are inexpensive, making them easy to adopt, and though they are disposable, they are surprisingly durable for a paper-like product.

I tested a commercial sleeve made by Samsonite—there are sleeves made by various other brands and no-name Chinese brands available online—with an NFC-enabled American Express charge card at three different retailers with tap-to-pay terminals: Target, Safeway, and an Asian grocery store chain in Northern California. The good news is that the sleeves blocked RFID communications between my credit card and the terminal.

The biggest downside with this solution is that there is friction when it comes to payment. It was clumsy to try to remove the sleeve from my leather bifold wallet and then remove my card from the sleeve to swipe, dip, or tap the card for payment. Additionally, the corners and edges of the sleeve wear over time. I find this solution works best on infrequently used cards that contain personal information, like IDs, driver’s licenses, and passport cards.

Add an RFID-blocking card to your favorite leather wallet

Chuong Nguyen

An alternative to protecting each card in your wallet with a sleeve is to sandwich your cards between two or more RFID-blocking cards. If you’re stacking your cards, you can just put all your credit and debit cards between two of these specifically made RFID-blocking cards, which are the same size and thickness as a regular non-embossed credit card, and they will do the trick.

Alternatively, if you’re using a traditional bifold wallet, you can put one of the RFID cards on each side of the wallet inside the cash compartment. When the wallet is folded closed, the blockers will prevent any RFID communication between any payment terminals and NFC readers with the cards inside your wallet.

While I found this solution to be a lot more elegant than the card sleeves, adding yet another two cards to your wallet can increase the bulk. For people who place their wallets in the back pocket of their pants, back pain caused by sitting on overly bulky wallets can lead to conditions known as wallet neuropathy and wallet neuritis, according to the United States National Institute of Health.

Ekster

Metal multipurpose card tools

But for people who prefer designer wallets—check out some of the recommendations for some bougie designs from our friends at GQ—or just love their existing wallet, the RFID-blocking cards are a great way to get a bit of extra protection for your physical financial information while being able to use a wallet that you’ve already invested in.

The biggest downside to this solution is that this is an inelegant fix for those who prefer slimmer cardholders. Typical cardholders accommodate between one and five cards, and using two of those slots for the RFID blockers would leave you with slots for only three cards. In my case, my cardholder accommodates only three cards for a slimmed-down minimalist carry, and I try not to use one slot to hold multiple cards. In this case, I would only have one slot remaining, which would hold solely my ID and nothing else. This is a non-starter for me.

The everyday carry community can also substitute an RFID-blocking card with a stainless steel multipurpose card tool. As metals block RFID signals, this solution adds more versatility to your wallet with a tool that you normally would have carried anyway. The caveat here is that you’ll need to see where the cutouts from the card tools are located and if they are properly aligned with the NFC antennas on your credit card to provide appropriate shielding.

Box wallets

Chuong Nguyen

Box wallets with fanning mechanism

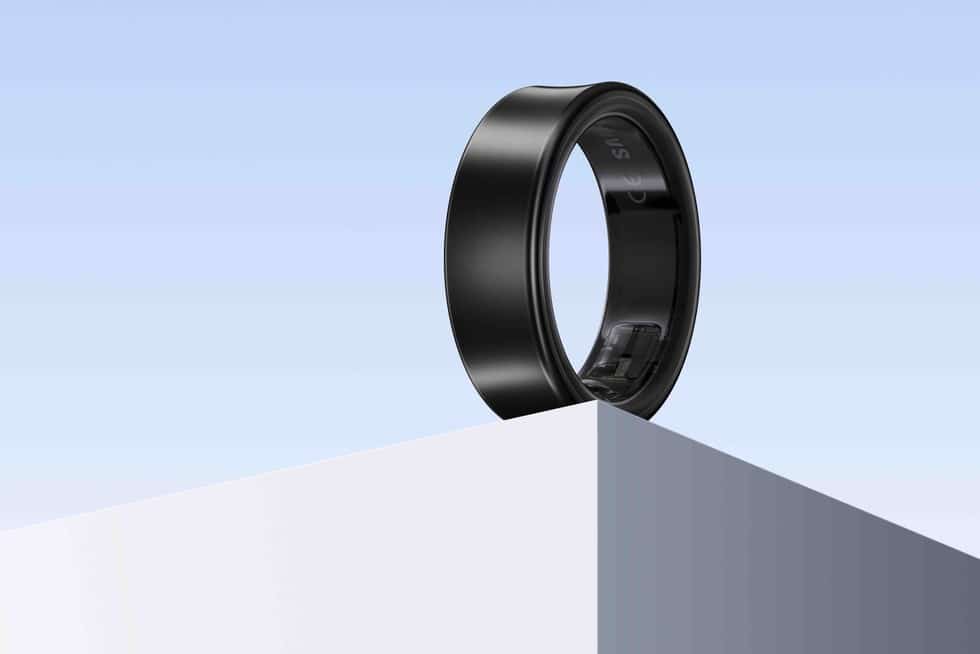

Box wallets have gained popularity in recent years, and the style has been favored in the EDC (everyday carry) community for its clean, minimalist aesthetic. Wallets from popular brands like Ekster, Ridge, Aviator, Groove Life, and more are often times constructed of a metal box with materials like aluminum or titanium that can shield the contents and block RFID readers. Recently, carbon fiber is also used as a premium alternative to standard steel, providing the same RFID-blocking protection.

There are two prominent styles of box wallets. The first uses a lever mechanism to eject the card and fan them out as they slide up, and this style is used on brands like Secrid, Ekster, and Groove Life, and most of these name-brand items sell for upward of $50. I tested a few cheaper alternatives from Amazon, promising the same ejection and card fanning mechanism from brands such as Vulkit.

While the cheaper products like those from Vulkit still feel durable and sturdy, I noticed that the cards tend to slide out if you turn the wallet upside down–especially if you have heavier metal credit cards–because of the lack of the silicone rails on the inside to secure the cards in place like on more premium models from Ekster or Groove Life. The card fanning doesn’t work quite as well, and sometimes all the cards just pop out in two stacks, making it difficult to identify the card you intend to use.

Many of the models that I’ve tested come with either a silicone or elastic band to help hold cash, and carrying a couple of bills folded into thirds or fourths is not an issue.

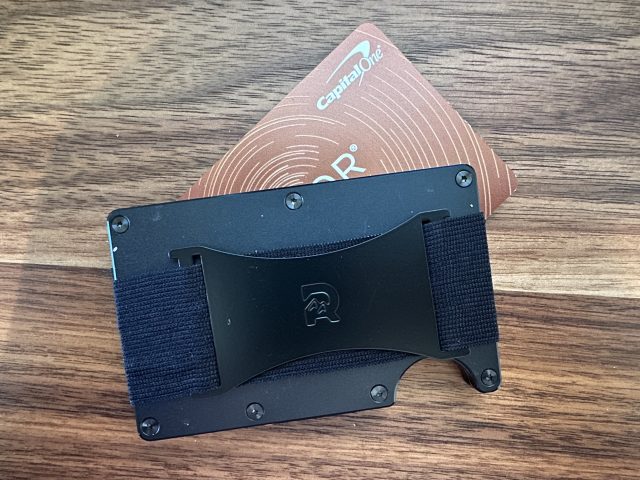

The second category requires mechanical force to retrieve the card, either by a strap to pull out the cards or a notch to remove them by pushing them out with your fingers. This style, embodied by Aviator Wallet and Ridge, is the ultimate in minimalism and is no bigger in dimensions than your standard card.

Essentially, it’s like having two metal or carbon fiber plates sandwiching your stack of cards. I found this style less elegant, as you still have to search for the card you want to use when you remove the stack. And like the styles with an ejection mechanism, you get what you pay for in this category regarding build quality and the materials used.

If you don’t like the minimalist aesthetic or feel of touching bare metal, some box wallets from premium brands like Ekster or Secrid also come wrapped in leather. Basic designs add leather as part of the design, while more functional variants from these manufacturers come with extra card slots in the leather wrap to store additional cards, folded bills, or other items. If you opt for this style, just be wary that cards not stored inside the RFID-blocking box may not enjoy the same protection.

An NFC-blocking wallet

Unless you want something that resembles a traditional wallet but comes with the necessary RFID-blocking tech built-in so you don’t have to reach for a card sleeve or RFID-blocking cards, I’d highly recommend you stay away from this option.

Often constructed of lower-grade leather or poorly made polyurethane (PU) shaped to resemble leather, these wallets just look cheap and won’t stand up to daily wear. If all you’re after is the RFID/NFC-blocking capabilities, these wallets performed as well in our testing as the box wallets. If you’re after a traditional bill-fold design, I’d recommend sandwiching some credit card-sized metal plates in the bill-fold area to help shield the NFC radio from the cards stored inside your wallet. This DIY hack allows you to use a wallet that matches your style so that you won’t be limited to cheap PU designs.

Testing methodology

To test the effectiveness of RFID-blocking capabilities and validate the manufacturers’ claims, we loaded the wallets that we reviewed with credit cards, debit cards, transit cards, and office key cards that contain RFID or NFC chips. According to the manufacturer’s specifications, the cards were loaded in their designated RFID-blocking compartments or card slots.

The wallets and the encased debit and credit cards were tested at self-checkout payment terminals at common national retailers that support tap-to-pay, including Target, CVS, Safeway, Costco, and Walgreens. Transit cards were tested at Clipper Card kiosks and terminals at boarding gates on San Francisco Muni buses, Bay Area Rapid Transit (BART) terminals, and Santa Clara County Valley Transportation Authority buses and light rail. We ran each wallet through a payment test at three credit card terminals at different merchants, a transit test using an NFC-enabled Clipper Card at two transit gates, and a building access test using an RFID card manufactured by HID.

In our non-scientific, real-world test, we found that all wallets in our review delivered on their promise and that when the cards are stored in the wallet, the NFC signal was adequately shielded and blocked to not initiate a payment when the wallet was held within 5 mm of the payment or transit terminals for three to five seconds. In our test, the cards within the wallets did not activate a payment, register a transit fare use, or access our building control. Given our findings, we’re confident that the issue highlighted by the ABC News coverage would have been preventable if the Safeway customer had used an RFID-blocking wallet.

Use a digital wallet on your phone as an alternative

Ron Amadeo

But with contactless payments gaining traction in the United States since the start of the COVID-19 health pandemic, your smartphone is perhaps the most effective and arguably the safest way to pay. Digital wallets such as Apple Wallet with Apple Pay and Google Wallet with Google Pay can accommodate a number of credit and debit cards–and soon digital IDs. While cash carry isn’t an option here, these wallets can also store coupons, membership cards, rewards cards, and more, making them a convenient alternative to a physical wallet.

And if you happen to accidentally leave your phone behind, smartwatches, such as the Samsung Galaxy Watch 5, the Apple Watch, and Google Pixel Watch, all come with NFC chips that will work with their respective digital wallets, and you don’t have to buy a new wallet or any accessories for your card. Stash your ID and a backup debit or credit card nearby in a sleeve, and you’re good to go!

Corey Gaskin

And since digital wallets use a tokenization system, they can be more secure than the NFC chips on your credit card. Additionally, with required biometric authorization to use, digital wallets can help safeguard against skimmers and hypersensitive payment terminals from picking up its NFC signals when you’re not actively trying to use your phone or smartwatch to pay, making it a safer alternative to having an uncloaked credit card in your wallet or pocket.

The ultimate aim of Apple and Google is to replace the content of your pocket with your phone and watch. That means in addition to boarding passes, train tickets, coupons, and rewards cards, you’ll be able to unlock your front door, remotely lock your car from afar, and more with your digital wallet. It’s the ultimate end to wallet neuropathy, but as phones ship with larger screens and bigger batteries, you’ll have to contend with carpal tunnel syndrome instead.