Has the Fed done enough?

The US report on consumer prices will be critical for investors trying to determine whether the Fed will stop raising interest rates. It’s expected to show a second straight reading for so-called core inflation that is consistent with the Fed’s 2{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5} target on an annualized basis, according to a preview from Bloomberg Economics. The Core Consumer Price Index, excluding food and energy, probably rose 0.2{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5} last month, following a similar increase in June, they said.

One potential pressure point could be commodities, which are rising after a year of falling. Oil traded near the highest level in almost nine months, with West Texas Intermediate futures above $84 a barrel after climbing 3{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5} over the previous two sessions.

Overall, I don’t see any evidence that prices have gone down in July. Food carries the heaviest weighting (13.7{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5}) on the CPI and that certainly has been going higher (anyone who’s been to a grocery store knows that) and Energy (6.1{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5}), as you can see, has gone up 20{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5} since July started but those are the two things they EXCLUDE from the Core CPI reading – because who actually uses food or energy, right?

In fact, when they talk about the “Core” CPI: Food (13.7{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5}), Food at Home (7.4{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5}), Food Away from Home (6.3{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5}), Energy (6.1{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5}), Energy Commodities (3.4{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5}), Gasoline (3{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5}), Fuel Oil (0.1{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5}), Energy Services (2.7{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5}) and Natural Gas (0.6{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5}) are excluded from the Fed’s consideration – leaving a very narrow view of inflation in Clothing, Cars, Medical Care, Drinks, Housing (32.8{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5}) and Airfare.

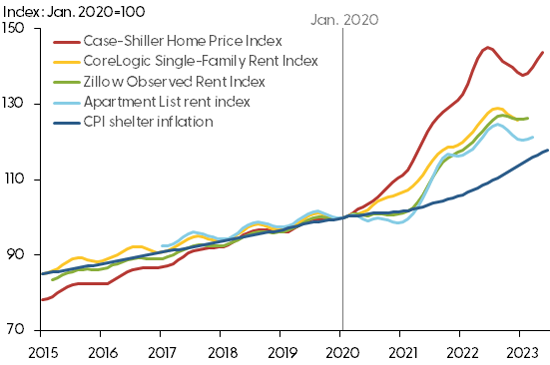

So, without Food and Energy, the Core CPI pretty much just measures housing and 23.9{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5} of Housing’s 32.8{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5} is Owner’s Equivalent Rent – and we discussed what utter BS that was back in May.

So, without Food and Energy, the Core CPI pretty much just measures housing and 23.9{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5} of Housing’s 32.8{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5} is Owner’s Equivalent Rent – and we discussed what utter BS that was back in May.

As you can see from this chart, OER is massively understated by the Fed – by 20-50{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5} – depending on who you trust (trust no one!). If you used the Case-Shiller Home Price Index (as we do for many things), then overall inflation would be running well over 15{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5} in the US for the past two years – EACH!

There’s not much point to Economic Reports if you pick and choose which data to include and exclude, much like survey’s of Americans only include people with phones. Perhaps this is why the homeless and the poor are completely ignored in this country – they are also voiceless and dataless – essentially they don’t exist.

None of this seems to be bothering traders this morning as our indexes are up about half a percent across the board (8:12) as we wait on the CPI data, where the consensus is for 0.2{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5} on the headline and 0.3{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5} at the core (which is higher than last month’s 0.2{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5} anyway).

The good news seems to be that China is meeting with Property Developers (but NOT Country Garden) on Friday after promising last week that they would increase funding support for the private property sector. Traders in the US have no concept of what a big deal China’s property bubble is for the Global Economy.

Country Garden mainly engaged in property development, construction, hotel management and, in 2019, they had revenues of $113Bn and profits of $16.9Bn but the real estate bubble burst and rather than pulling back, China Gardens diversified into electric vehicles, robotics, agriculture, and education and that went about as well as you would expect for a bunch of over-leverage real estate guys desperately trying to find a big winner in tech.

As of June 30th, Country Gardens had accumulated $271Bn in debt, which is 2.5 TIMES it’s equity and the company has been struggling to repay its creditors, as its cash flow and liquidity have deteriorated amid a slump in sales and a difficult refinancing environment. It has missed interest payments on several bonds this month, triggering fears of a default that could have systemic implications for the Chinese Economy and the Global Financial Markets. By comparison, Evergrande had $340Bn in debts (2{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5} of China’s GDP) and lost $81Bn before the Government was forced to step in for an ongoing restructuring which is iffy at best.

Country Garden has been seeking funds from various sources to avoid their own collapse, such as selling assets, negotiating with bondholders, applying for bank loans, and requesting government support. However, none of these measures have been sufficient or successful so far. The company still faces a large amount of debt obligations in the coming months, including $2.9 billion of offshore bonds that will mature by the end of December. It’s possible that Friday’s meeting will be about dividing up their assets among the other developers – which would amount to a MASSIVE Government bailout.

8:30 Update: Core CPI came in at 0.2{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5} and headline CPI was 0.2{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5} so yay, I guess. That’s running at an annualized 3.2{dec8eed80f8408bfe0c8cb968907362b371b4140b1eb4f4e531a2b1c1a9556e5} level and the Fed meets again in a month. Apparently, there were a lot of base effects bringing the numbers down so it’s really nothing to get too excited about – despite the positive headline – which is all you will hear about from the MSM cheerleading squad today.

IN PROGRESS