Canada’s inflation rate jumped higher last month, to an annual pace of four per cent, mostly because of an increase in gasoline prices.

Statistics Canada reported Tuesday that the inflation rate ticked higher by 0.7 percentage points, in large part because gasoline prices increased on an annual basis for the first time since January.

Pump prices increased by 4.6 per cent in August alone, and are up by 0.8 per cent compared to where they were a year ago.

Energy prices tend to have an outsized impact on the overall inflation rate, because they filter down into everything else, from production costs to transportation of goods.

Karleen Jack is feeling the pinch of higher gasoline prices on two fronts — as a small business owner and as a consumer. She runs Lawn Warriors Property Maintenance, a business providing outdoor maintenance such as yard care, leaf and snow removal, in Ajax, Ont., just east of Toronto.

She normally services clients from all over the region, but the high price of gasoline right now has forced her to limit the distance she’s willing to go.

“We’ve had to be creative,” she told CBC News in an interview. “Based on the increases from last year, we had to zone down to a smaller territory.”

From gas in her truck to premium fuel for her hedgers, leaf blowers, trimmers and mowers, she feels every pump increase directly. She estimates her costs rose by about 15 per cent last year, but she hasn’t been able to pass those increases on to her customers. So she’s cutting back on the number of jobs she takes on and the amount of income her family-run business gets from every one.

“You can do that — but within reason and only for so long,” she said.

Fuel isn’t the only thing getting more expensive either. Prices for other essentials, like food and shelter, continued to increase.

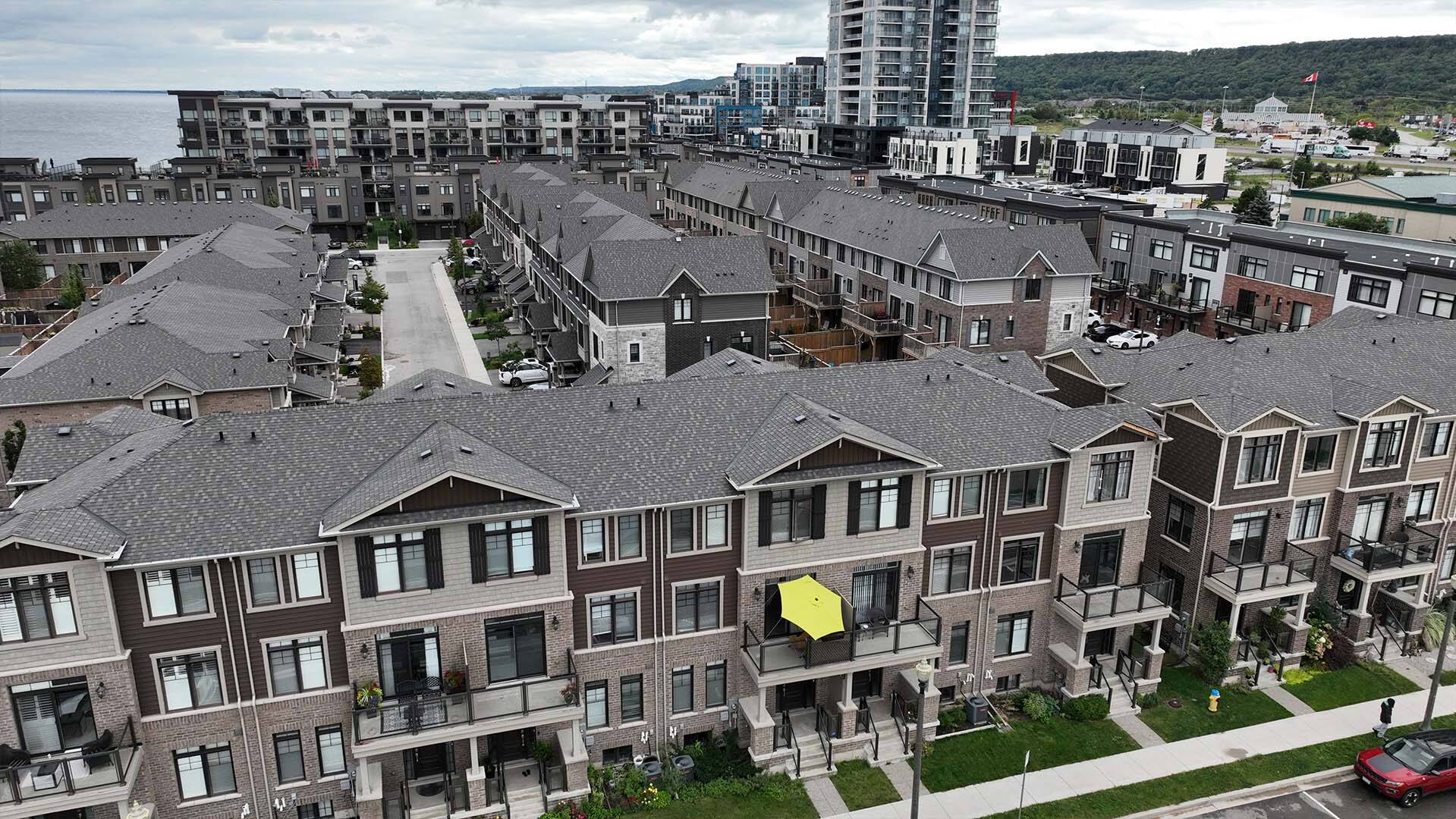

The cost of keeping a roof over your head increased by six per cent in the year up to August, an uptick from 5.1 per cent in July. Within that, rent was a major factor, with average rents increasing by 6.5 per cent across the country.

It didn’t get any cheaper to own, either.

Mortgage interest costs rose by another 2.7 per cent during the month, and are now clocking in at a 30.9 per cent increase in the year up to August. That’s up from July’s already-eye-watering level of 30.6 per cent.

A rise in gas prices is driving Canada’s inflation rate higher. Statistics Canada reports the annual inflation rate rose to four per cent in August, beating many economists’ expectations and raising the possibility of another interest rate hike.

There was one source of comparable relief, however, from an unexpected place: the grocery aisle.

The price of food purchased from stores increased by 6.9 per cent in the past year. While that’s still almost twice the overall inflation rate, it’s down from recent highs of more than 11 per cent.

It’s also the slowest annual increase to the typical grocery bill since January 2022.

While that may be good news for most Canadians, anyone waiting for an outright decline in their grocery bill is likely to be disappointed. Economist Robert Kavcic with Bank of Montreal says “there’s a big distinction between slowing inflation, which is good news and actually outright declines in in prices.”

“If you go from eight per cent inflation to let’s say one or two per cent, that doesn’t mean the price of your grocery bag is falling,” he said in an interview. “We’re going to get some relief in terms of the inflation rate, but not necessarily what it costs you to actually go out and buy food and feed your family.”

The unexpectedly high inflation number upped the odds of another rate hike by the Bank of Canada to as much as a 50/50 chance, but Kavcic says a lot can happen between now and the Bank of Canada’s next rate decision on October 25 — including another inflation number, for September.

“In a month or two, if we’re still looking at inflation prints like this, I think the Bank of Canada might in fact actually have to come off and and and take another stab at this,” Kavcic said, adding that he still thinks the bank is likely to stand pat for a while.

“Rates are probably high enough to do the job. They just haven’t been high enough for long enough.”