“I went down to the crossroads“ – Cream

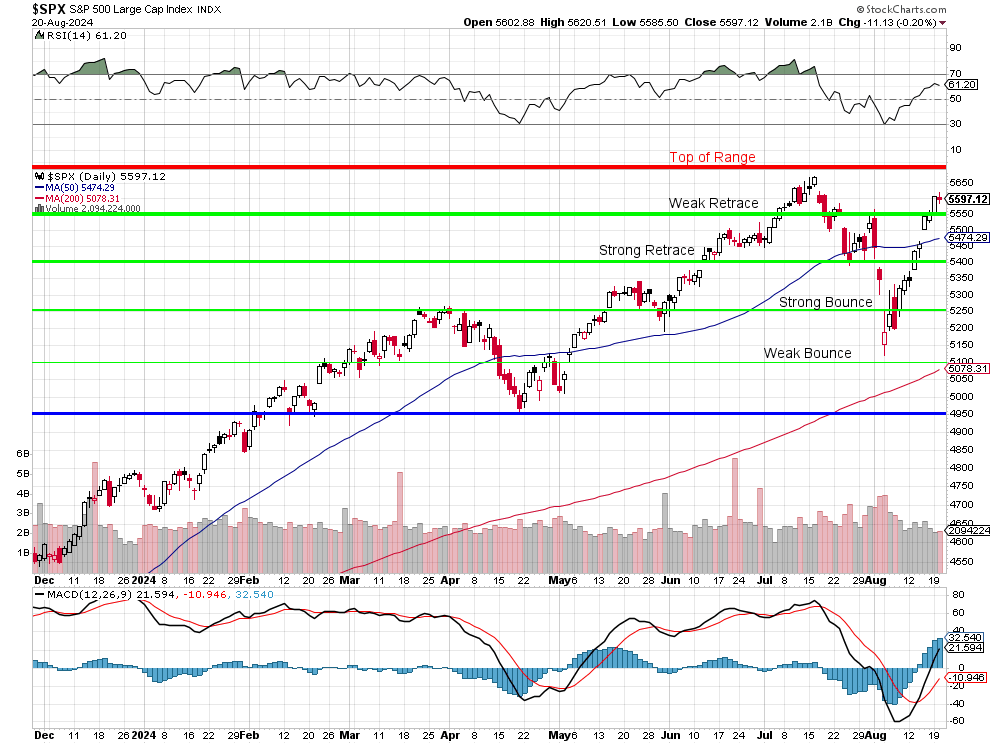

We’re either making a double top or breaking out to new highs and that’s riding on the reading of the Fed Minutes, revisions to the Payroll Data and earnings from NVDA and Retailers, with Macy’s (M), Target (TGT) and TJX (TJX) all beating expectation but also all pointing ahead to a “challenging” environment with stressed-out consumers. And did you realize we’re still waiting for NVDA next week?

The Federal Reserve will release the minutes from its latest meeting at 2pm today, and they may disappoint rallying investors who are hoping for a dovish pivot. The market has been on a tear lately, with the S&P 500 up over 5% in the past month, but the question remains: is this rally sustainable?

Yesterday’s Democratic convention saw some fiery speeches from the Obamas, who took aim at Donald Trump and his policies. Michelle Obama, in particular, offered a searing assessment of Trump’s hostility towards her family, warning voters against choosing “another four years of bluster and bumbling and chaos.” The convention also saw a historic first, with Doug Emhoff, husband of Vice President Kamala Harris, giving the traditional first lady’s speech as the would-be first gentleman.

Yesterday’s Democratic convention saw some fiery speeches from the Obamas, who took aim at Donald Trump and his policies. Michelle Obama, in particular, offered a searing assessment of Trump’s hostility towards her family, warning voters against choosing “another four years of bluster and bumbling and chaos.” The convention also saw a historic first, with Doug Emhoff, husband of Vice President Kamala Harris, giving the traditional first lady’s speech as the would-be first gentleman.

Today we have the official revision to the jobs numbers, which could provide some more insight into the state of the Economy. The market will be watching closely to see if the numbers confirm the recent strength in the labor market, or if they suggest that the recovery has been losing steam. The revision could also have implications for the Fed’s monetary policy decisions going forward.

As noted Target and TJX both reported solid earnings, giving futures a lift this morning. Target beat earnings expectations by $0.39 and reported revenue in-line with estimates, while also raising its full-year EPS guidance. TJX beat earnings expectations by $0.04 and revenue estimates, while guiding Q3 EPS below consensus and FY25 EPS in-line. However, Macy’s missed on revenue and lowered its guidance, sending its stock down over 6% in pre-market trading. The company beat earnings expectations by $0.23 but missed on revenue, and reaffirmed its FY25 EPS guidance while guiding FY25 revenue below consensus and lowering its comparable sales guidance.

Other notable earnings reports included Toll Brothers (TOL), Coty (COT), Keysight (KEYS), Analog Devices (ADI), and La-Z-Boy (LZB). Toll Brothers beat earnings expectations by $0.29 and reported revenue in-line with estimates, while also providing Q4 guidance, increasing its expected repurchase total for FY24, projecting FY24 EPS above consensus, and raising its adjusted gross margin forecast.

Coty missed earnings expectations by $0.08 and reported revenue in-line with estimates, while guiding FY25 EPS in-line. Keysight beat earnings expectations by $0.22 and revenue estimates, while guiding Q4 EPS and revenue in-line. Analog Devices beat earnings expectations by $0.07 and revenue estimates, while guiding Q4 EPS and revenue in-line. La-Z-Boy beat earnings expectations by $0.02 and revenue estimates, while guiding Q2 revenue below consensus.

Japan reported a July trade deficit of 760Bn Yen (only $5.2Bn), with imports up 16.6% year-over-year and exports up 10.3% year-over-year. South Korea’s July PPI came in at 0.3% month-over-month and 2.6% year-over-year. Australia’s July Leading Index was flat month-over-month. New Zealand’s July Credit Card Spending was down 3.8% year-over-year. In Europe, the UK reported July Public Sector Net Borrowing of 2.18Bn Pounds, much higher than the expected 500M.

Overall, there are a lot of cross-currents in the market right now, and investors will need to be nimble to navigate them. The Fed minutes will be key, as they could set the tone for the rest of the week and those come out during our Live Trading Webinar at 1pm, EST – so join us this afternoon for live analysis of the minutes as well as a look at our new Money Talk Portfolio!

So buckle up and get ready for a wild ride!