Consumer prices in Britain rose at the slowest rate in two and a half years, the country’s Office for National Statistics reported on Wednesday.

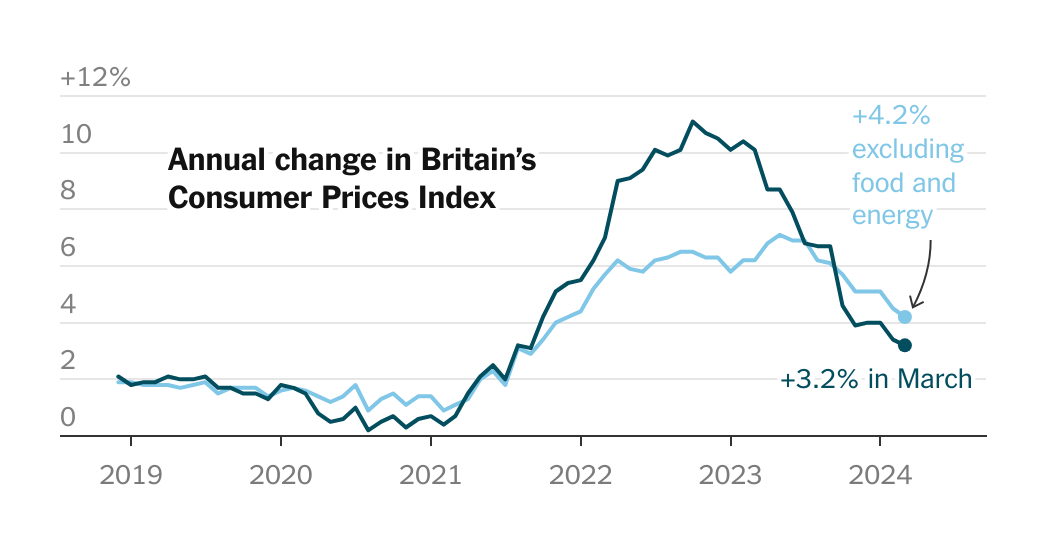

Inflation was 3.2 percent in the year through March, down from 3.4 percent in February but a touch higher than the 3.1 percent economists expected, a sign that the path to cooler inflation could be bumpy. Core inflation, which strips out volatile food and energy prices, was 4.2 percent, down from 4.5 percent the month before.

Economists expect inflation to continue to slow over the next few months, possibly going below the Bank of England’s target of 2 percent, as household energy bills fall. Overall inflation peaked at 11.1 percent in October 2022.

The weakness of the economy has put pressure on the central bank to cut interest rates. Britain’s unemployment rate rose more than expected in its latest reading, published this week.

This presents a “difficult balancing act” for the Bank of England, Jake Finney, an economist at PwC, wrote in a note. Slowing inflation puts pressure on the bank to cut rates “to get the economy growing again,” he said, but policymakers probably want “more conclusive evidence that we have achieved a sustainable return to target before they pivot to rate cuts.”

Last month, the Bank of England left its key rate at 5.25 percent for the fifth consecutive meeting.

The U.S. Federal Reserve has also held rates steady at recent meetings. The Fed is likely to wait longer than initially expected to cut rates, given stubborn inflation data, its top two officials said this week.

Last week, the European Central Bank gave its clearest signal yet that it might lower interest rates at its policy meeting in June, as inflation in the eurozone slows and the region’s economy languishes.