Happy 5,000 day!

It looks like the S&P 500 is finally going to open over 5,000 and, hopefully, it will stay there and give us a record-high close. It’s an Olympic year, so it’s appropriate to set records but what do they give you when you set a record – GOLD! Think about it…

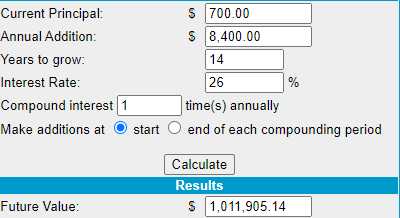

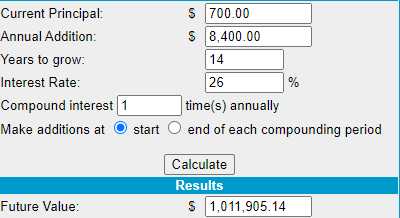

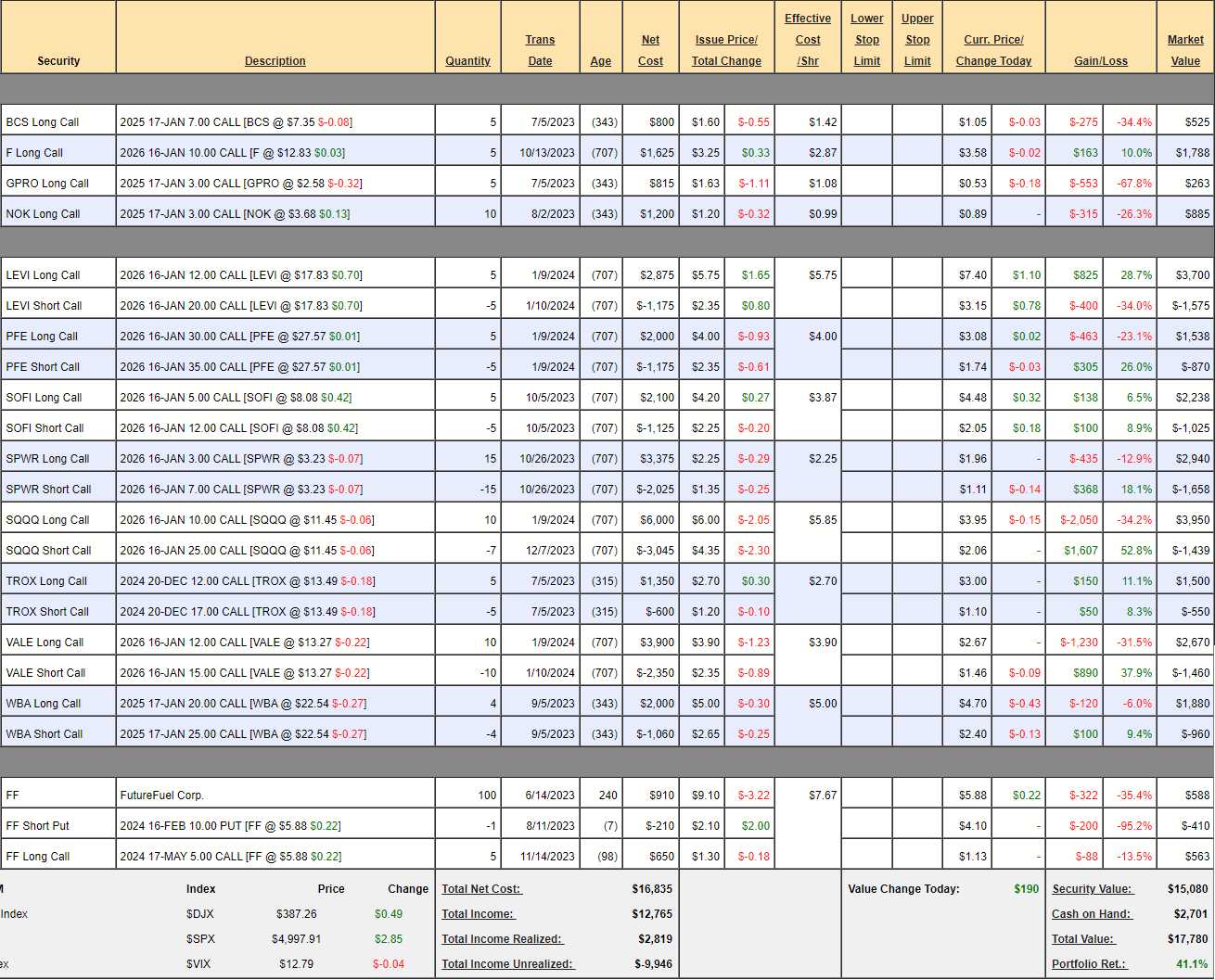

Meanwhile, it’s month 18 for our $700/Month Portfolio where we began with $700 back on Aug 25th, 2022 and now, 17 months later, after adding $11,900, our portfolio stands at $17,780 – up 41.1% and way over our goal of returning 10% per year. At this pace, call it 26% per year, it will only take us 14 years to get to our $1M goal but, so far – you haven’t missed much as we’re effectively going to take $17,780 and make $1M over the next 13 years!

You can go over months 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16 and 17 to see all the moves we’ve made to get this far. This is a small portfolio, which means we can’t use all of our favorite option techniques yet – but it’s a great way to learn how to get started on a wealth-building adventure.

As of our last review on Jan 9th, we had $11,942 of upside potential in the existing trades, that would be good for another 67% gain over the next two years (if all goes well) but of course we’ll be adding new trades along the way. As expected last month, we currently have $1,701 of buying power after adding this month’s $700 so let’s review our positions and go shopping!

-

- BCS – We have a year but underperforming so far. We expect $10 and that would be $1,500 and currently it’s $525 so $975 (185%) upside potential.

- F – We have two years on this one and $15 is our target, which would be $2,500 and currently net $1,788 but we can now sell 5 of the 2026 $15 calls for $1.30 ($650) and that would drop our net to $1,138 with $1,362 (119%) upside potential – so we’re doing that. We’re raising almost a month’s worth of savings AND we’re protecting the downside for our long calls at the same time.

-

- GPRO – Earnings were a disappointment and we only have a year but I’d rather keep it in play for now than take the loss – only because it’s just $263. Happy to get even but not counting on it.

- NOK – It’s a building year and we certainly expect to see $5, which is $2,000 and currently $885 so we have $1,115 (125%) upside potential.

-

- LEVI – Blasting higher and well on track for the full $4,000. Now net $2,125 so $1,875 (88%) left to gain would be good for a new trade at ordinary trading sites, right? That’s just our leftovers!

- PFE – Cheaper than our entry at net $668 on the $2,500 spread so there’s $1,832 (274%) upside potential which I’m very confident about. And remember – these are no-margin trades!

-

- SOFI – Had great earnings but traded down. Just net $1,213 on the $3,500 spread so there’s $2,287 (188%) of upside potential if we can get back to $12.

- SPWR – There is a LOT of work to be done if our Stock of the Decade is going to perform by Jan 2026. Earnings are next week so we shall see. This is a $6,000 spread currently at net $1,282 so there’s $4,718 upside potential but we’re not counting on it until we see earnings.

-

- SQQQ – Our hedge cost us $443 for the month as the market kept climbing but that’s the cost of insurance against these unrealized gains getting realized if the market keeps going higher. Unfortunately, as SQQQ goes down, we have to recalculate the potential and we assume a 20% drop in the Nasdaq gives this 3x inverse ETF a 60% gain from $11.45 to $18.32 so that’s our potential ($8.32) or $8,320 and currently we’re net $2,511 so we have $5,809 downside protection using this hedge. We can get our loss back by selling 3 2025 $18 calls for $1.50 ($450) and it has no effect on our insurance coverage – so why not?

-

- TROX – We have another year but it hasn’t done much since July. It’s a $2,500 spread at net $950 so there’s $1,550 (163%) upside potential at $17, which seems far away at the moment.

- VALE – Our Trade of the Year is off to a bad start as we wait for China to get serious about stimulus. It’s still a $3,000 spread but now the net is just $1,210 so there’s $1,790 (147%) of upside potential at our modest $15 goal.

-

- WBA – Right where we started in September and that’s halfway to goal at net $920 on the $2,000 spread so we have $1,080 (117%) upside potential in 12 months.

-

- FF – Took a dive recently but now recovering. We sold the $5 calls (should be 1, not 5!) and we’ll roll them to increase our target, hopefully to Jan $7.50s. At $7.50 we get back $750 and (after correcting) it’s net $65 so there’s $685 (1,085%) upside potential – because we’ll roll the short put too!

So there’s 13 trades remaining (some were cashed in already) after 17 months and our portfolio has a net $17,780 value with $14,551 (81.8%) of upside potential that we still feel good about. We also have $5,809 worth of downside protection, and that protection is net $2,060 (after selling the new calls) – so, even if we lose that entirely, we will still have a great 2-year gain – and that’s without adding new trades!

This, by the way, is what you should be doing with all of your portfolios. If you don’t know where you’re going and you don’t know where you’ve been – how can you tell if you are on the right path or not? Trading should not be a mystery – it should be a science. Goldman Sachs (GS) understands that and JP Morgan (JPM) understands that and BlackRock (BLK) understands that and Warren Buffett (BRK.A) understands that – we should too!

Amazingly, not many people in the World do understand that and they treat trading like it’s gambling but even gambling is a science – for the house! That’s why our mission statement at PhilStockWorld is Be the House – NOT the Gambler – take it seriously!

Have a great weekend,

Become a Member and join us inside! You will gain access to our 6 Member Portfolios as well as Trade Ideas, Our Legendary Live Chat Room, Live Trading Webinars, Trading Education and other exclusive perks.

Find out why Forbes called Phil “The Most Influential Stock Market Professional on Twitter” (in 2016, before Elon ruined it!).

Email Maddie – Admin@philstockworld.com – for a 7-day FREE trial at sign up.